Juniper, a London-based company, has secured £1.5 million in pre-seed funding to launch a novel reproductive healthcare insurance offering for employees. The funding round, led by Insurtech Gateway with contributions from 2100 Ventures, Exceptional Ventures, and Heartfelt, as well as several angel investors, is aimed at establishing Juniper’s presence in the insurance market, with a focus on supporting employees’ reproductive health needs.

The startup, formed in 2023, addresses the inadequacies in traditional health insurance by providing inclusive genital insurance for all genders. In the UK, reproductive or gynecological issues affect a significant portion of the population. Juniper’s comprehensive cover is designed to provide end-to-end reproductive health support, including access to testing, routine checkups, and medical reimbursement.

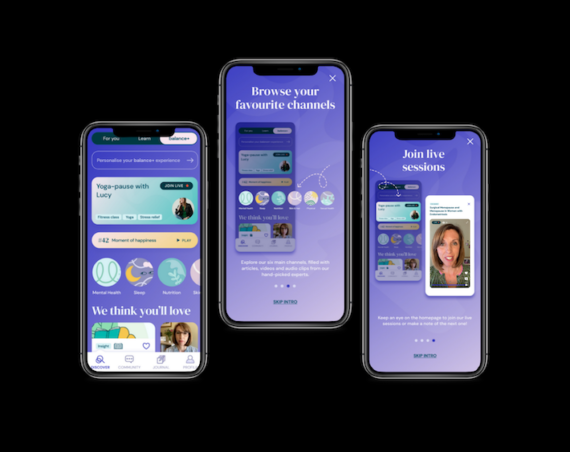

Ambra Zhang, Co-Founder and CEO of Juniper, said: “I was diagnosed with polycystic ovarian syndrome (PCOS) early on, and my corporate health insurance didn’t cover it, as PCOS was classified as a chronic reproductive condition. So, every year, I would pay £1,000 out of pocket to see my gynecologist get my prescription. Juniper bridges this gap by providing end-to-end reproductive health support for employees and offers tailored, high-quality insurance products for employers and brokers. Our digital platform aims to revolutionize the insurance industry by meeting the unmet needs of the new generation.”

Juniper’s insurance products are tailored for medium to large enterprises that prioritize employee well-being and are engaged in ESG initiatives. The coverage extends to a range of reproductive health matters, including contraception, STD testing, and conditions like endometriosis and erectile dysfunction. Notably, Juniper also covers topics often excluded from traditional policies, such as gender dysphoria, egg freezing, and menopause.

The European market for such services is significant according to the company, with a potential worth of £30Bn. Juniper’s approach is set to differentiate from traditional insurers by focusing on high-frequency claims with moderate costs, addressing essential but often neglected health needs.

Lead investor Insurtech Gateway’s Co-founder Robert Lumley shared: “When Juniper asked us to imagine dental insurance, but for your genitals, it opened our eyes to a substantial market largely ignored by traditional insurance. Juniper is removing the stigma surrounding reproductive health issues and enabling employers to offer comprehensive care for all employees. We are delighted to join them on this journey.”

With the pre-seed investment, Juniper plans to expand its team and advance through its pilot phase toward an official launch, aiming to reshape the reproductive healthcare insurance landscape with its inclusive and comprehensive offerings.