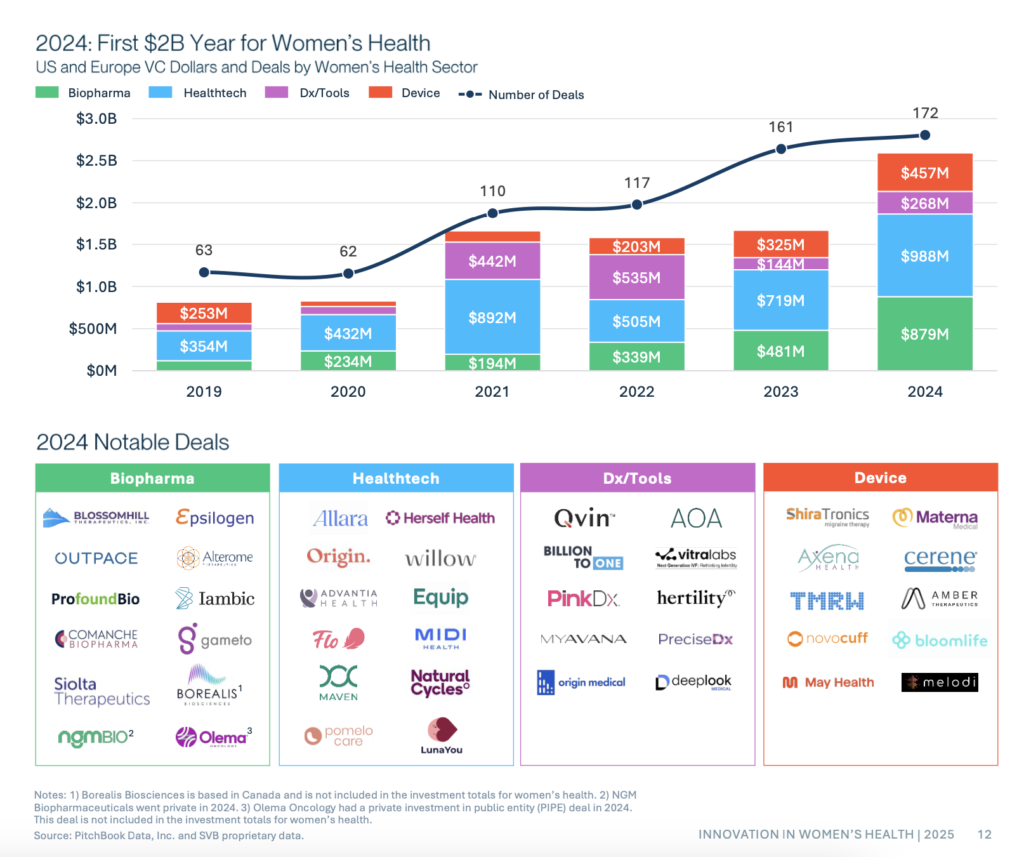

Investment in women’s health has reached unprecedented levels, hitting $2.6 billion in 2024 according to the latest report from Silicon Valley Bank (SVB). The 2025 Innovation in Women’s Health Report details how funding in the sector surpassed 2023’s total by nearly $1 billion, signaling growing recognition of both the unmet needs and market opportunities in women’s healthcare.

A Sector Coming of Age

According to SVB’s analysis, when including funding for related diseases that affect women differently or disproportionately, total investment in the women’s health sector rose to an impressive $10.7 billion in 2024. This represents significant growth in a space that accounted for less than 2% of overall healthcare investment in 2020 but has grown more than threefold since then.

“Investment in women’s health continues to reach new milestones, driven by a growing recognition of the ways in which health conditions impact women differently,” said Raysa Bousleiman, co-author of the report and senior vice president for Investor Coverage in Life Science and Healthcare at SVB. “While 2025 may present challenges, the long-term potential of the sector is clear, and we expect continued investment focused on addressing the unmet healthcare needs for women.”

Key Trends Reshaping Women’s Health Investment

The report identifies several important shifts in the women’s health investment landscape:

1. Sector Diversification Following Healthcare Trends

As the women’s health sector evolves, it is increasingly diversified, following patterns seen in the wider healthcare industry. Investment in healthtech solutions dropped from 54% in 2021 to 38% in 2024, while biopharma investment surged to 34%, up from just 12% in 2021. This indicates a maturing sector moving beyond digital solutions to more complex therapeutic approaches.

2. Investment Stages Maturing

In 2023, seed and Series A deals made up 83% of women’s health investments, compared to 72% in the overall healthcare space. This gap narrowed significantly in 2024, with seed and Series A deals representing 70% and 67%, respectively, of total deals in each sector. This suggests women’s health companies are increasingly progressing to later funding stages.

3. Precision Medicine Takes Center Stage

Funding flooded into early-stage startups focused on filling gaps in clinical pathway guidelines for women’s health. In 2024, VC investment in precision medicine startups totaled $3.6 billion, up from $1.4 billion in 2023. Companies investigating autoimmune, cardiometabolic, and neurodegenerative conditions received some of the largest funding rounds.

4. Evolution Beyond Traditional Women’s Health Categories

The report argues that women’s health is broader than typically defined. Many conditions disproportionately affecting women—such as autoimmune diseases, Alzheimer’s, and depression—represent significant investment opportunities that are often not categorized as “women’s health.” The authors note: “Is investment in women’s health issues even bigger than we think? Women are more likely to die following a heart attack and have a higher risk of death or hospitalization after coronary bypass surgery. Eighty percent of rheumatoid arthritis patients and 90% of lupus patients are women. Two-thirds of Alzheimer’s patients are women, and women are nearly twice as likely as men to be diagnosed with major depressive disorder or to seek treatment for behavioral health needs.”

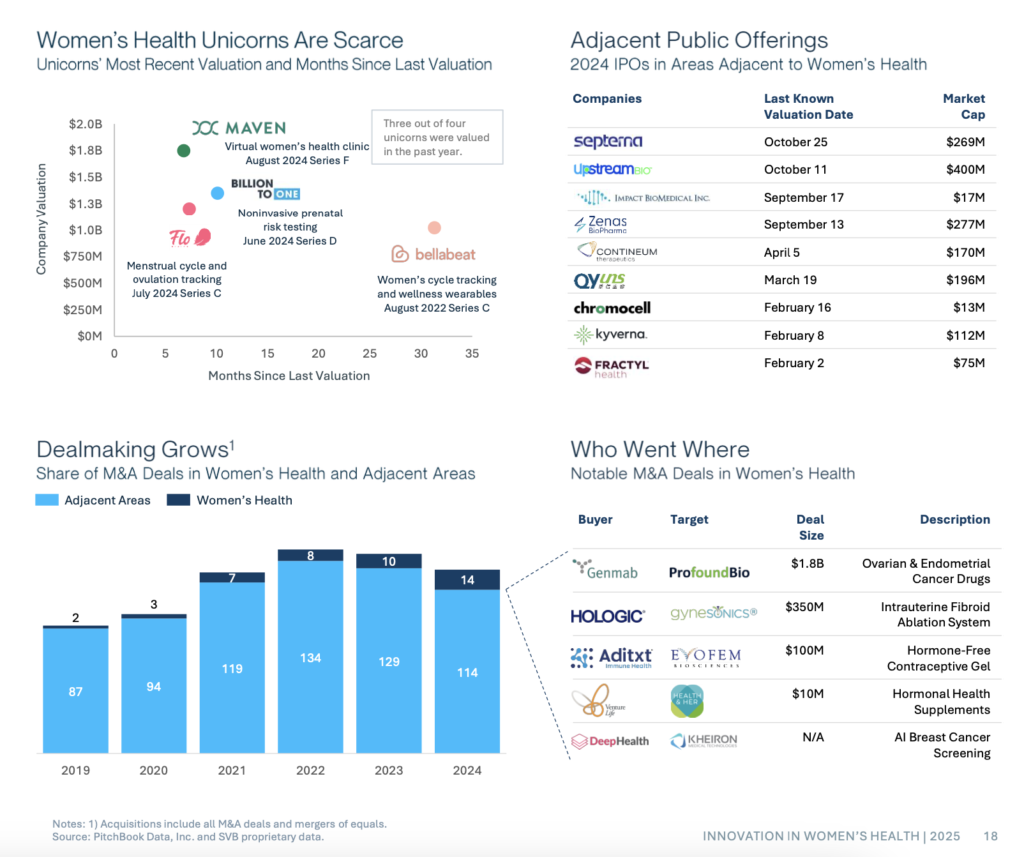

5. Exit Challenges Remain Despite Growth

Despite the sector’s rapid growth, exits remain a challenge. Investors reported difficulties finding comparable companies and concerns about potential returns. However, recent IPOs and M&A activity in adjacent areas suggest that women’s health could help break the exit logjam in the broader healthcare market.

As Jackie Spencer, Head of Relationship Management for Life Science & Healthcare Banking at SVB, noted in the report: “Startups are finding that serving historically underserved or disadvantaged populations in healthcare can boost the bottom line, aid in retention and play a vital role in improving and maintaining patient health.”

Funding Waves Show Evolving Priorities

The report identifies a clear progression in women’s health funding over time:

- 2019-2020: Investment focused primarily on fertility and pelvic health solutions

- 2021-2022: Funding surged for pregnancy-related care including maternal health

- 2023-2024: Investment in oncology took off, with capital flowing into diagnostics and treatments for breast and ovarian cancers

This pattern mirrors broader trends in digital health, with investors moving from consumer-focused tools to clinically validated and tech-enabled solutions.

Looking Beyond Traditional Categories

The SVB report makes a compelling case for expanding how we view women’s health. Maria Toler, Founding and Managing Partner at SteelSky Ventures, observed: “We hurt ourselves by saying, ‘There hasn’t been women’s health M&A.’ The truth is, there are a lot of companies that just aren’t calling themselves ‘women’s health.’ We just need to start using those as comps. When we do it that way, there are actually a lot of similar companies that are acquired.”

Theresa Sexton, Managing Partner at Claritas Capital, highlighted the nascent nature of investment networks in this space: “There isn’t a mature enough syndicating network among equity investors in women’s health yet. I’m hopeful we’re going to start seeing more investors in the market to support these companies.”

Precision Medicine: A Key Opportunity

The report devotes significant attention to precision medicine and personalized health approaches for women. As Anna Mason, Managing Partner at Ingeborg, explained: “Women’s physiology is different. There are different care pathways, different types of treatment plans, or symptoms that might present differently or need to be diagnosed differently. When precision medicine works, it inherently means that these changes take shape for women.”

Kriti Subramanyam, Senior Associate at RA Capital, summed up both the opportunity and challenge facing the sector: “There’s a recognition that the market for these conditions is huge. … The piece that remains a question is, ‘Who’s the acquirer here? Where do these companies go?'”

The Future Outlook

The SVB report points to several factors that could further accelerate growth in women’s health investment:

- Blue ocean opportunities: The report notes, “there are LPs that are specifically looking for women’s health-focused funds.”

- Integrated healthcare models: Companies combining traditional medication with personalized support services, particularly in areas like menopause and perimenopause, are showing strong growth.

- Recognition of gender disparities: Greater awareness of how conditions affect women differently is driving investment in tailored solutions.

As women’s health continues to command greater investment attention, the report suggests the sector is moving beyond its niche status to become a mainstream investment category with significant growth potential across multiple healthcare segments.

For investors, entrepreneurs, and healthcare systems alike, the data points to a fundamental shift: women’s health is no longer simply a subset of healthcare but rather a diverse, complex, and increasingly well-funded ecosystem addressing some of medicine’s most significant unmet needs.