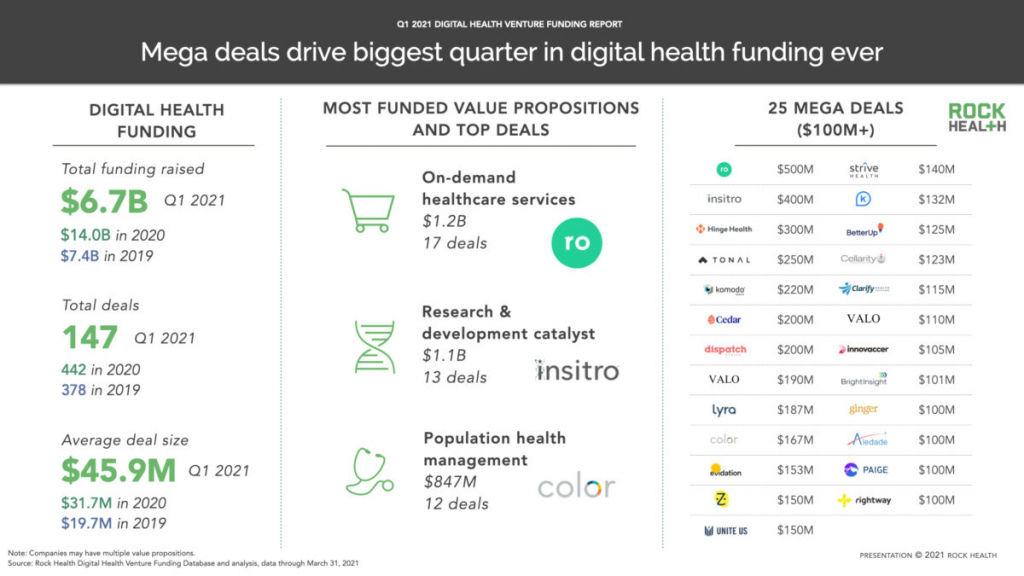

Rock Health has recently released their Q1 2021 digital health funding report. With $6.7B in US digital health funding Q1 has been the the most-funded quarter to date.

Ten years ago, we at Rock Health published our first report on digital health venture investment, highlighting an annual haul of $1.1B from investors into the emerging sector. In each of the last two weeks of March 2021, investments in digital health topped $1B+. And with $6.7B invested across Q1 2021, the largest quarter of funding ever, the digital health sector is on track to significantly outpace 2020’s $14B+.

In other words: We’re all grown up.

The pandemic prompted an acceleration in the adoption and mainstreaming of digital health. The surge in venture funding over the past twelve months likely reflects investors’ appraisal of the opportunity this acceleration creates. And it parallels some of the rapidly-maturing fundamentals of the sector in terms of consumer adoption, clinical impact, and of course, digital health’s role in responding to the pandemic. Over the past decade, private digital health companies have also captured a larger share of overall venture capital dollars, moving from just 2% of all venture investment in 2011 to 9% in 2020.

Digital health is in a pivotal moment. Innovators, investors, and buyers are rightfully exuberant for digital health to transform discovery, care delivery, and well-being. But adults still have to wear their seatbelts—especially on fast rides.

Bursts of heightened activity—particularly from an investment and exit standpoint—must also be examined with caution. This means closely evaluating untested business models, new investment vehicles, skyhigh valuations, and funding trajectories that don’t match the recent past. These departures from a more tempered market will enable breakthrough winners and impact. But we also anticipate some Icarus-esque endings. In this growing market, exercising judgment will be critical. Stakeholders will need to separate long-term value creation from short-term financial opportunity, and distinguish between individual company hype cycles from overall sector fundamentals and growth.

Across this Q1 funding recap, we dive into the factors that have led us to this moment—and share our perspective on emerging dynamics (mega deals, roll-ups, and SPACs, oh my!) that are shaping the steep slope of growth in digital health.

Source: Rock Health