The following is a guest post authored by Reenita Das, Partner & Sr. Vice President, Healthcare & Life Sciences, Frost & Sullivan and Suchismita Das, Lead Femtech Analyst, Healthcare & Life Sciences, Frost & Sullivan.

The healthcare industry has traditionally been built by men for men. Although women comprise 50 percent of the global population and take 80 percent of healthcare decisions in the household, healthcare devices, drugs and technology have traditionally rarely been tested on women in clinical trials or adapted to meet their needs. Today, this is changing fast…the watershed moment has arrived as female voices have taken centre stage and 2022 promises to bring new hope to women’s health issues that had previously been kept under wraps.

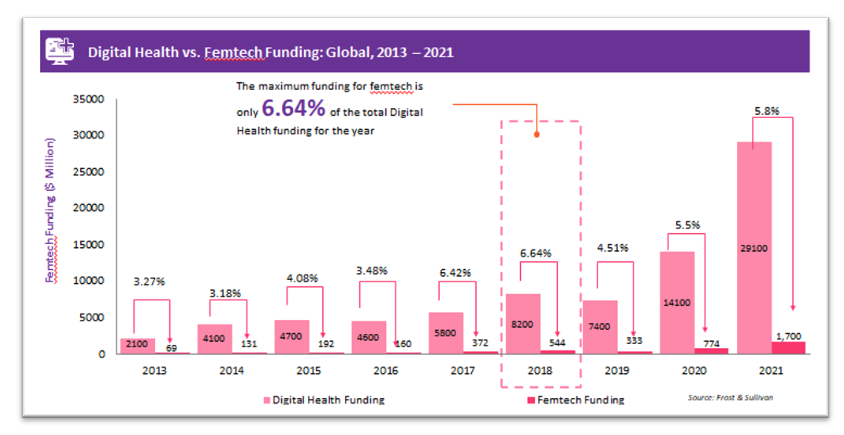

Currently, the global femtech industry is witnessing an oestrogen surge. The COVID-19 pandemic played the role of a catalyst by accelerating acceptance and adoption of women-specific health solutions and technologies. 2021 had been a stellar year for global femtech as venture funding crossed the $1.7 billion mark for the first time.

Femtech vs Mentech: Is there a Bias?

Recently, we focused on reviewing and contrasting men’s health versus female health and some enlightening analysis emerged. It is apparent that mentech-focused companies have higher visibility, get funding more easily and achieve unicorn status quicker than female technology companies. For instance, Maven Clinic started its operation in 2014 and reached unicorn status only in 2021 after it secured Series D funding and achieved a valuation of more than $1 billion. In contrast, HIMS (men’s wellness brand, specifically known for erectile dysfunction medication), launched in November 2017, achieved unicorn status with a valuation of €1.5 billion as early as January 2019. Why is mentech receiving more funding than femtech? Is erectile dysfunction considered to be more important than women’s health issues around infertility, menstruation and pregnancy? Or do the venture caps, which are largely male, view the commercial opportunity of male products differently than female health products? While women make all the purchase decisions for healthcare, we would assume that they would be stronger consumers for healthcare compared to men. Obviously, stereotypical bias still plays a part.

Strategies of Success for Femtech Startups

There are over 1,200 female technology companies globally at different stages of revenue cycle. Here are some of the best practices and lessons learnt from the past:

- Femtech Startups Need to Position and Brand themselves as Mainstream through Partnerships and Acquisitions: for instance, Maven Clinic’s recent partnerships with five Fortune 15 clients, including Microsoft, helped to achieve a retention rate of almost 100%. Needless to state, this strategy increased its membership (for employer and payer-sponsored clinical programmes) rate to nearly 400% year-over-year, thus taking the revenue to much higher numbers. Similarly, the unicorn status achieved by Kindbody in early 2022 resulted from its acquisition of Vios Fertility Institute and its chains.

- Providing Holistic Care to Specific Women Needs: From menstruation, fertility and reproductive health, femtech is now expanding to provide holistic health, including polycystic ovary syndrome (PCOS), hormonal awareness, pelvic health and fitness, mental health, menopause and other issues related to women’s health. Startups such as Alpha Medical, MyAva (PCOS), Elektra Health (menopause), Lisa Health (menopause), Elda Health (customised services), Maven Clinic (whole-person care), and Zoie Health (health services for African women), among others, are taking women’s health to the next level by providing specific services to cater to specific needs. Holistic approach with personalized care – will that be the next approach to address women’s health issues?

- Targeting Employers with Employer Benefit Solutions: Femtech startups such as Carrot Fertility, Jessie, Caia, Progyny, Flo Health Inc., among others, offering women-health solutions on the basis of membership as well as employers benefit solutions. These employer-curated benefit platforms enable women employees to turn to their employers for accessing and availing of a network of women and family health providers. Rather than taking the direct-to-customer (D2C) approach, femtech startups adopted the approach of business-to-business-to-consumer (B2B2C) by selling directly to an employer. This approach is majorly driven by the increasing demand from female employees for fertility and pregnancy care, and family planning. This, however, begs the question as to how the non-working female population can access these benefits.

- Care Delivery Shift towards Women-only Health Clinics: As the entire healthcare industry is witnessing the shift in care delivery towards clinics/centres outside the hospital, the femtech industry is also in sync with the trend. Providing a range of services and products addressing issues from adolescence to menopause, the “female-focused centers” provide trusted and safe services, either virtually or in-clinic, or a combination of both by serving only female patients. Led by women, a few instances of women-only clinics include HerMD, Maven Clinic, Tia Clinic, and Parsley Health. Moreover, in the US, ambulatory surgery centres (ASCs) are tackling women healthcare disparities by opening “women-only” centres, for instance Lee Health (Florida) is opening a cardiac surgery centre for female-only patients, and NYU Langone Health (New York) has already opened a new outpatient centre for women’s health.