This guest post was written by Zohar Horovitz-Limor, VP Product, Eng.MBA, Gyntools and Itamar Netzer, MD MBA, Israeli Ministry of Health.

Israel is considered by many to be a startup and technology dynamo, ranked by Bloomberg’s Innovation Index as number six in the world for its overall score. This is no small feat for such a small country, and yet, this seeming powerhouse that has been the source for many ubiquitous technologies in space exploration, personal computing, telecommunications, molecular biology and AI/machine vision, is not known to be as prolific in Femtech and Women’s Health. This is especially surprising when one considers that Israel is a nation of mostly fecund young residents, with one of the highest birth rates in the developed world (3.04 per woman, compared with 1.66 average in OECD countries). Why has its Femtech sector not been as prominent so far? In this paper we will explore this question, try to answer it and identify the existing conditions in the Israeli Healthtech ecosystem that may soon make it ready for picking the low hanging fruits of Femtech innovation.

Introduction

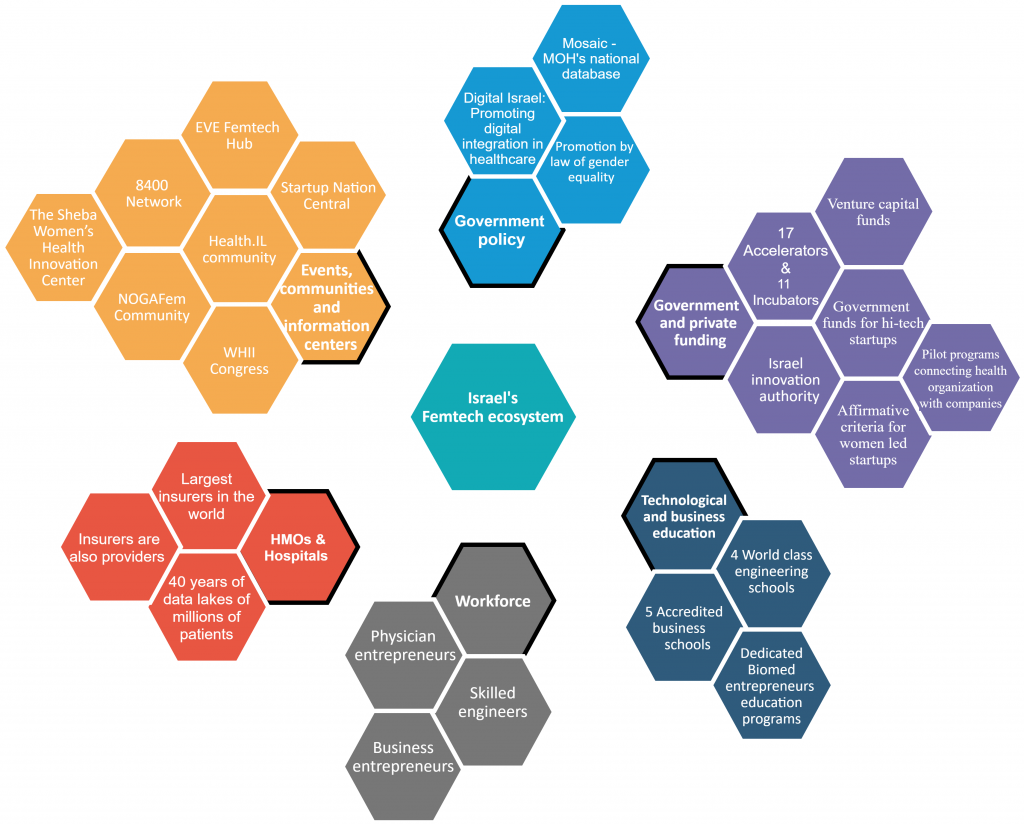

The Israeli tech ecosystem is uniquely poised to nurture and support Healthtech and biomedical ventures. Figure 1 presents the main components of the ecosystem, including government policy, funding by private companies and government, technological and business education, the technological workforce, the health system and finally, events and communities. The main driving force of these ventures is the combined efforts of the Ministry of Economy and Industry, and the Ministry of Health, through a network of grants, government-subsidized accelerators, and incubators. Special consideration is given to entrepreneurs who are women, including programs intended to nurture and fund their startups. The health system itself is a robust network of four large insurers-providers (Health Maintenance Organizations – HMOs) serving 100% of the country’s residents, coupled with large secondary and tertiary academic hospitals, and decades of digital health records on file.

Uniqueness of the Israeli Ecosystem

Although the Israeli health system is not as highly funded as in the USA or other OECD nations, its health outcomes, such as lifespan and infant mortality, are among the best in the world. This is brought about by a very efficient system that includes high-turnover, ultra-modern hospitals, coupled with robust community care that receives most of the national funding. Primary care is organized into four HMOs (the largest of which, Clalit Healthcare Services, encompasses nearly 5 million insured individuals), providing access to primary and consultant care, telemedicine, and at least two decades worth of electronic health records. In terms of entrepreneurs conducting beta-testing or clinical trials for health apps and medical interventions, this makes Israel on par with the best university medical systems in the US such as those of Boston or Stanford, at more affordable prices. According to popular media, this has also been the impetus that convinced Pfizer to speed up its delivery of Covid19 mRNA vaccines to Israel in order to reach full coverage of all citizens above age 16 by late March 2021, using it as a “global model state”.

Another consequence of this ecosystem is the ease in which new partnerships are formed and supported financially. One such example is the collaboration between the Israeli Innovation Authority’s “Pilot Program” and health institutions. This has led to quick incorporation of product trials into existing HMOs. Izhar Laufer, the Innovation Manager at “Leumit Health Services”, describes an example of this collaboration: “During 2020, Leumit healthcare was cooperating with four new innovative solutions for new medical products under the pilot program, two of which were in women’s health. The pilot with Gyntools is a good example for such a cooperation including realization of how women’s health issues are addressed within the HMO. The support of the pilot program enabled us to conduct a clinical study testing the possible outcomes of adding new technology to the HMO.”

Israel has done much to earn its reputation as “The Startup Nation” with over 6000 startup tech companies, and an economy dominated by industrial high-tech and entrepreneurship. This has drawn more than 376 multinationals to set up Israeli branches, including Microsoft, Motorola, Google, Apple (three R&D centers), Facebook, Berkshire-Hathaway, Intel, HP, Siemens, GE, IBM, Philips, Cisco, Applied Materials, IBM, J&J, Medtronic and Toshiba. Looking at the Life Sciences sector as a whole (1500 companies), it is divided into 650 digital health companies, 600 medical device companies with 295 of the companies active in diagnostics and 255 in pharmaceuticals according to the Startup nation central internal database.

Investment in Recent Years

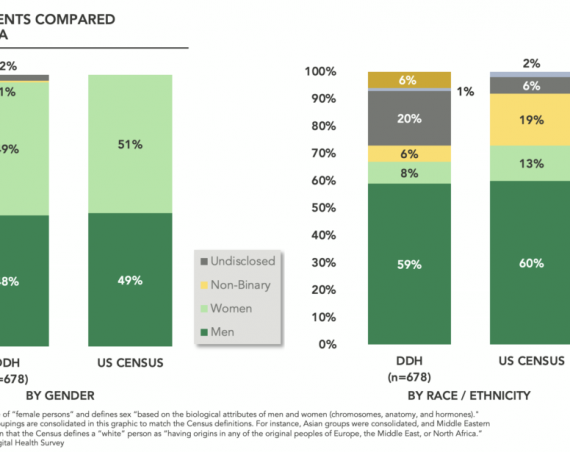

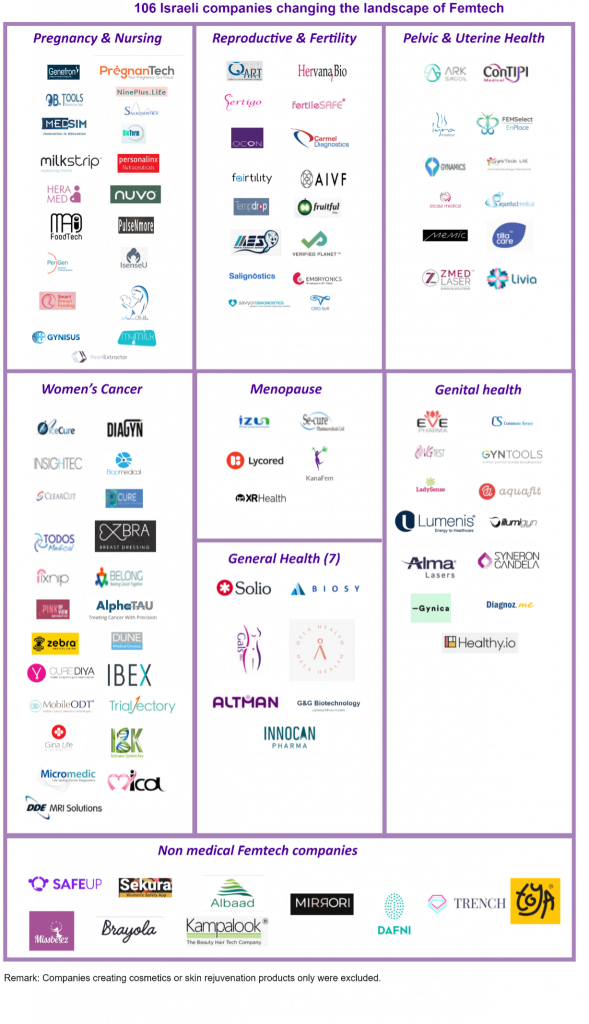

The current inventory of Femtech and Women’s Health in the country is not negligible, despite its lack of publicity. According to Startup Nation Central’s Finder (described below) data, there are now 106 different companies in Femtech or Women’s Health, including some that are not geared specifically towards women but also address women’s health issues through their primary indications. These are presented in Figure 2, and we categorized these as Pregnancy and Nursing (20 companies), Reproductive Health and Fertility (16 companies), Pelvic and Uterine Health (12 companies), Women’s Cancer (23 companies), Menopause (5), Genital Health (13), and General Health (7). We also chose to include ten Femtech companies that are non-medical, for their unique contributions to women’s needs and wellbeing.

According to Lena Rogovin, Senior Digital Health Analyst at “Startup Nation Central” , a non-profit organization mapping the Israeli ecosystem and making it approachable for the global high tech and ventures community, each of the Femtech companies can be found in the organization’s Start-up Nation Finder platform categorized as a women’s technology related company. This enables investors or companies seeking collaboration to quickly identify their target portfolio. However, the troubles plaguing Femtech entrepreneurs the world over are shared by the ones in Israel, namely, lack of funding. The funds raised by high-tech companies in Israel exceeded $10B in 2020, of which $1.75B were from the Life Sciences sector5. The two most highly funded Digital Health subsectors in 2020 were Diagnostics and Remote Monitoring, with 44% and 18% of

investments, respectively. According to Dr. Benny Zeevi, one of the founders of the first Israeli Femtech conference, “Women’s Health Innovations & Inventions (WHII)”, in the past six years only, an estimated $574 million was invested in Israeli startups in the fields of Femtech and women’s health. discounting an additional $150 million was invested in Insightec for its non-gynecological applications, and an estimated $160M before that was invested in companies that serve other indications in addition to women’s health. Most of these investments have gone into only a few companies, leaving the majority of current Israeli Femtech and Women’s Health startups underfunded. From our discussions with founders and CEOs in the Israeli Femtech/Women’s Health sector, and with local caregivers, it is apparent that Israel is a microcosm for the rest of the world. As we see abroad, our ecosystem suffers from a peculiar dissonance – doctors and medical administrators appeal for greater technological innovation in women’s health and are willing to endorse innovation. At the same time, male investors do not identify with women’s health needs, fail to grasp the potential market dealing with women, and thus tend not to invest in female-specific health technologies.

Effects of Covid-19

The Covid-19 pandemic and crisis beginning in March 2020 threatened to engulf many early and middle stage tech startups, in health as well as in other areas. However, the reverse happened – while many ventures overseas stalled or reached the ends of their runways, the Israeli Innovation Authority and other government agencies began awarding funds to companies who would pivot to help deal with the crisis, including but not limited to early-stage ventures. Coupled with increased local and overseas sales of late-stage companies, many digital medicine companies received a serious boost to funds and accelerated clinical trials, creating a local boom in all areas of the Life Sciences sector. These equity-free government investments often require matching funds by external investors, creating a unique opportunity in the local market.

Prediction for the Next Few Years

The current trends in the Israeli Life Sciences sector lean heavily towards telehealth, machine learning in pattern recognition applications, point of care technologies and remote patient monitoring. In 2020, The Israeli Innovation Authority launched its flagship “Bioconvergence” program – aiming to fund and support new enterprises in the intersection between medicine, biology and engineering. This is expected to be both a driving force for the economy and a strategy to combat the rising costs of healthcare.

The Israeli Femtech and Women’s Health sector is poised for a golden age. It is aided by a local health and Medtech ecosystem that has multiple components supportive to its needs – promotion of women entrepreneurs, a highly skilled technological workforce, a robust health system that is fully digitalized, ample wet and dry lab and digital facilities and infrastructures, and heavy integration of academic institutions with the local high-tech industry.

Conclusion

Although billions of dollars are raised every year by local high-tech startups, little of it goes into Femtech. Despite all its innovative thinking, the Israeli venture capital arena has yet to recognize the value of a market selling to over 50% of the people, betting instead on tried-and-true markets where most progress is incremental at best – namely, cardiac or orthopedic medical devices. Israel has no dedicated large scale venture capital funds specializing in women’s health that can support all funding stages – A, B, C and beyond, and insufficient exposure to the outside world.

This makes dozens of Israeli Femtech companies ripe for the picking by overseas investors.