Femasys has marked a series of milestones in recent weeks, advancing both its U.S. regulatory pathway and European commercialization for FemBloc, a non-surgical permanent birth control method.

The company received FDA Investigational Device Exemption approval to continue enrollment in the final phase of the FINALE pivotal trial for FemBloc. The approval follows completion of Part A of the multi-stage trial design and represents a step toward potential U.S. Pre-Market Approval.

Alongside the regulatory milestone, Femasys secured $12 million in senior secured convertible notes led by existing investor Jorey Chernett. The financing includes warrants that could bring total potential proceeds to $58 million if exercised for cash. Proceeds will be used to refinance existing debt and advance commercialization of the company’s fertility and permanent birth control portfolio.

“This FDA IDE approval represents a critical milestone in advancing FemBloc toward U.S. approval, bringing women a long overdue, non-surgical option for permanent birth control, as women in Europe and other select countries are now beginning to benefit from this important innovation,” said Kathy Lee-Sepsick, Chief Executive Officer and Founder of Femasys.

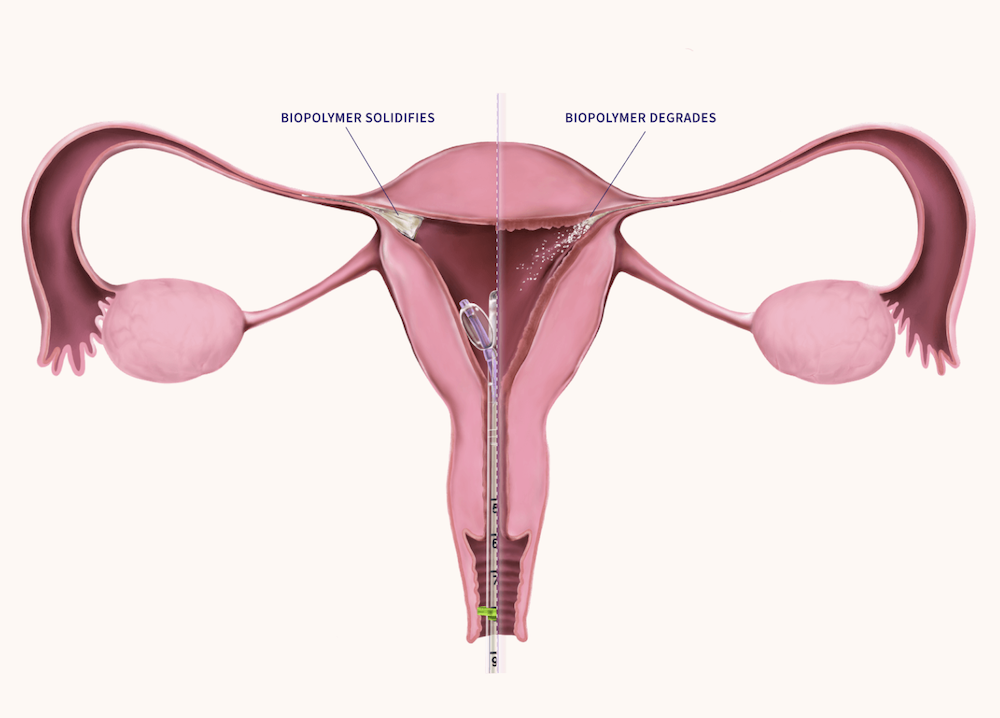

FemBloc uses a patented delivery system to place a polymer into both fallopian tubes, which degrades and forms scar tissue for permanent occlusion. The procedure requires no anesthesia, no incisions, and no recovery time. FemBloc received regulatory approval in Europe in June 2025, the UK in August 2025, and New Zealand in September 2025.

In Europe, Femasys announced an initial order valued at approximately $500,000 for the commercial launch of FemBloc in France and the Benelux region through its partnership with distributor Kebomed. This follows the company’s recent entry into Spain.

“Our selection of European partners, such as Kebomed, has been deliberate and strategic, ensuring both deep expertise in market access and a shared commitment to advancing women’s healthcare,” said Lee-Sepsick. “The initial orders reflect confidence in FemBloc’s potential to transform reproductive health.”

“For several years, there has been a void in permanent contraception options, with no new advancements to meet the clear demand from both women and physicians,” said Søren Dalmark Kornerup, Chairman of Kebomed Europe AG. “FemBloc represents a revolutionary breakthrough that the market has been waiting for, and we are thrilled to be at the forefront of introducing this much-needed solution.”

The convertible notes bear 8.5% annual interest and have a 10-year maturity. The notes are convertible into up to 16,378,563 shares of Femasys common stock at a conversion price of $0.73 per share, representing a 15% premium to the closing price immediately prior to the agreement.

Femasys also offers FemaSeed Intratubal Insemination for infertility treatment and FemVue for fallopian tube assessment. Published clinical trial data shows FemaSeed is over twice as effective as traditional IUI. The company trades on NASDAQ under the ticker FEMY.