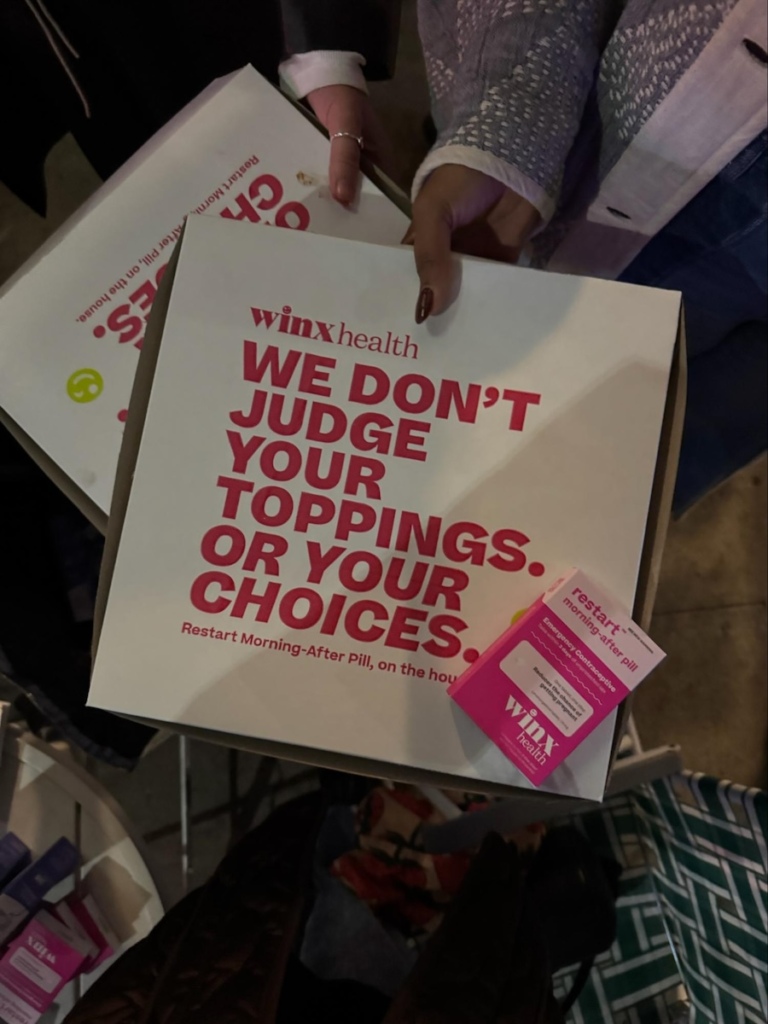

On a packed Saturday evening in trendy Brooklyn, Gen Zers lined up outside Fini’s Pizza, waiting not just for slices, but for free morning-after pills handed out by the Winx Health team. It was the launch celebration of their retail partnership with Walgreens, complete with the kind of chaotic energy that only a femtech brand throwing a pizza party to celebrate emergency contraception could muster.

Fast forward to 9:35 p.m. at a local Walgreens, where a newly stocked, neatly packaged Winx Health section sits prominently on the shelf – morning-after pills and UTI take-home tests displayed with the confidence of any other healthcare product. No shame, no hiding behind the pharmacy counter, just visible, accessible reproductive healthcare sitting next to the Band-Aids and Tylenol.

This is the essential playbook for Gen Z women’s health and it’s happening in physical stores.

Gen Z Is Shopping IRL And Companies Need to Meet Them There

While the 2010s DTC playbook emphasized social media and direct sales channels over traditional retail, Gen Z’s shopping behavior tells a different story. Nearly two-thirds of Gen Z prefer in-store shopping over online, according to L.E.K. Consulting signaling a rate higher than millennials, Gen X, and baby boomers. For discovering new products specifically, that number jumps to 64%. Health and beauty products remain the most reliable draw for in-store traffic, and Gen Z’s combined in-store purchases account for nearly 50% of their total spending, positioning them as the most authentically “omni” shopping generation yet.

Getting on shelves not only acts as a distribution strategy but as legitimacy infrastructure.

The Shelf as Sex Ed Classroom

“50% of people believe emergency contraception is illegal in their state, when it’s actually legal in all 50,” said Jamie, Winx Health’s founder, noting the staggering misconceptions around reproductive healthcare. “And 73% of women think the morning-after pill is the same as the abortion pill, which it’s not.” She pointed to the education gap as a core problem: “Only 38 states require sex ed, and just 17 require it to be medically accurate.”

Winx’s emergency contraception product, now on shelves at more than 6,000 Walgreens nationwide. The company is improving access while creating de facto sex education in states that gutted comprehensive health curriculum. The shelf becomes the classroom.

Gen Z shoppers find it easier to vet a product’s quality and ethical claims when they’re physically in store, a critical factor for women’s health products where transparency and trust matter deeply. Seeing emergency contraception at Walgreens sends an institutional signal that this is real healthcare and not a sketchy internet product.

The Economics of Physical Retail for Femtech

The economics back this up. Retail channels contributed 51.85% to the global femtech market revenue, thriving on tangibility and trust. When probiotic brand Seed launched at Erewhon, their DS-01 product became the top-selling probiotic. At Target, it reached the top 10 in Vitamins, Minerals, and Supplements within three months. Physical retail drives impulse discovery that direct-to-consumer can’t replicate, creating what industry insiders call “pure incrementality” while reaching existing customers more conveniently and attracting consumers who’ve never heard of the brand.

Jamie’s approach with Winx has been to meet Gen Z’s openness with educational content that doesn’t talk down. “We’ve found Gen Z to be far more open when it comes to talking about contraception and vaginal health,” she said. “They’re curious, proactive, and want information that’s research-backed.” The brand’s content strategy reflects this: “All of our content is rooted in science and reviewed by OBGYNs, but we communicate it in a voice that feels real and scroll-worthy. Education can be smart and cheeky.”

Education Meets Cultural Fluency

This combination of credibility and cultural fluency has driven real results. Following new abortion measures on state ballots, Winx saw a 69% jump in revenue, a 322% increase in social impressions, and a 537% spike in emergency contraception sales. The company frames this as “reproductive optionality” giving women real choices and removing shame from those decisions.

“I remember taking pregnancy tests hoping we were not pregnant and feeling shame,” Jamie recalled, explaining the mission behind Winx. “Reproductive optionality for Winx is about giving women real choices and removing the shame that’s often tied to them.” Advocacy, it turns out, drives business.

The trend extends beyond emergency contraception. Viv for Your V, a vaginal health brand, recently launched in Sprouts and Whole Foods. Seed expanded from Erewhon to Sprouts after building momentum online and on Amazon. August, the tampon brand, landed at Target. This signals a clear pattern that direct-to-consumer femtech brands are re-entering physical retail on their terms. The results is that women’s health is becoming visible, educational, and shame-free.

The Winx Playbook for Femtech Founders

For founders watching this shift, the playbook is crystallizing. Retail placement equals institutional credibility in categories where Gen Z is hungry for trusted sources. The shelf serves as education when formal health education fails. In-store campaigns—pizza parties, Times Square billboards—turn product placement into shareable cultural moments. And crucially, retail drives discovery economics and impulse purchases that create pure incrementality over digital channels, while simultaneously building brand awareness that feeds online sales.

Physical retail drives discovery economics that create pure incrementality over digital channels, while simultaneously building brand awareness that feeds online sales. Each channel expansion reaches existing customers more conveniently while attracting entirely new ones who stumble across products during regular shopping trips.

Visibility as Strategy

The Walgreens partnership represents something larger than distribution for Winx. At 6,000+ locations nationwide, emergency contraception sits on shelves in states with comprehensive sex education and in states where health curriculum barely exists. It’s in conservative towns and progressive cities. The product’s physical presence makes a statement: this is normal healthcare that you’re allowed to access without shame, judgment, or misinformation.

Women’s health is becoming visible, normalized, and IRL. And Winx Health, with its pizza parties and prominent shelf placement, is leading the way. For a generation that grew up online but craves physical verification of trust, the future of femtech might just be found at the corner drugstore after all.