Italy’s femtech sector includes 92 mapped companies serving women’s health innovation, according to the first comprehensive study by Tech4Fem’s FemTech Observatory. Despite rapid recent growth, the ecosystem faces significant funding challenges and operational barriers that limit scaling potential.

Funding Remains a Critical Challenge

Nearly 38% of companies have not raised external capital, with most relying on personal investment (64%) and company turnover (44%) for financing. Traditional venture capital reaches only 17% of companies, while private equity involvement sits at 3%. Business angels provide more support at 28% participation.

Revenue concentration shows the early-stage nature of the market. Half of all companies report annual turnover below €50,000, with 25% generating zero revenue. Total estimated revenue ranges between €41-100 million, with investment raised estimated at €32-77 million. Only 12% of companies have raised more than €1 million.

Market Focus and Business Models

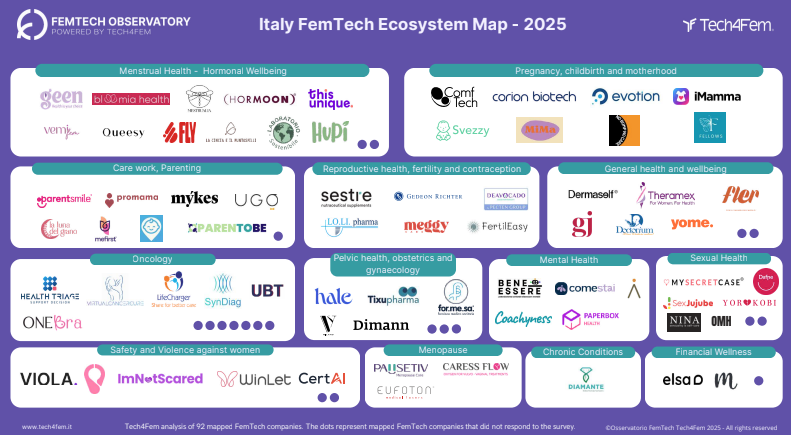

Menstrual health and oncology each represent 14% of active companies, followed by pregnancy and maternity at 10%. Pelvic health, general wellness, and caregiving each account for 9% of ventures.

Business models split between B2C (42%), B2B2C (33%), and B2B (25%). While 54% of companies serve exclusively female users, many solutions engage broader communities, particularly in caregiving contexts.

Operational Challenges

Half of companies report medium-to-high difficulties with online communication due to platform censorship affecting women’s health content. Some 57% experience bias-related obstacles when dealing with banks, investors, and partners.

Technology adoption shows companies are increasingly data-focused, with 62% collecting and processing user information and another 24% planning to begin data collection initiatives.

Innovation and Products

Software solutions lead at 18% of offerings, followed by advocacy and education (15%), supplements and therapies (14%), and virtual health services (14%). Medical devices comprise 10% of products, while advanced categories like pharmaceuticals represent 6%.

The distribution suggests focus on accessible solutions rather than highly regulated medical interventions.

Market Maturity

The sector shows rapid expansion, with 45% of companies founded between 2023-2025. Company development stages reflect this momentum: 47% are in validation phase, 31% scaling operations, and 18% at efficiency stages.

Legal structures favor traditional formation (72% limited liability companies), though 53% qualify as innovative startups and 14% choose benefit corporation status.

Support and Reception

Regional institutional support remains weak, with 50% rating assistance as minimal and only 6% reporting strong government engagement. Corporate receptiveness proves more promising, with 40% reporting high openness to femtech partnerships and 35% indicating moderate interest.

Future Outlook

The data reveals substantial potential constrained by systemic barriers. While innovation and entrepreneurship are strong, sustainable growth requires addressing funding gaps, operational obstacles, and institutional support deficits. Success depends on whether Italy can create conditions for femtech to scale beyond its current bootstrap phase into a mature, well-funded ecosystem capable of competing internationally.