A new analysis from AOA Dx has tracked 276 women’s health company exits between 2000 and 2024, revealing over $100 billion in total exit value and 27 billion-dollar transactions. The report, titled “Follow the Exits,” presents what the authors describe as the first comprehensive analysis of exit values in women’s health, challenging the perception that the sector is nascent or unproven.

“Market narratives have long framed women’s health as niche or narrowly focused on reproductive care – a misconception that has obscured the sector’s true scale and returns,” wrote Anna Milik Jeter, Co-Founder of AOA Dx and co-author of the report. “Viewed through this lens, women’s health is not a nascent opportunity. It is a substantial, established segment of healthcare with a long track record of value creation.”

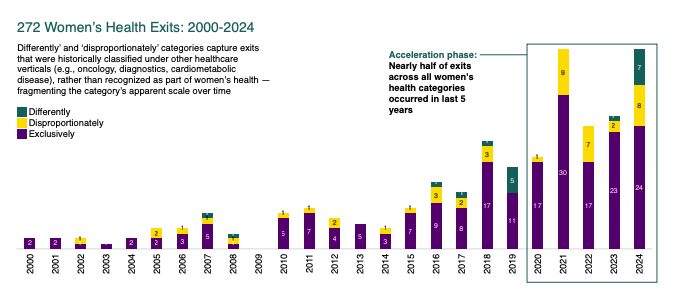

Accelerating Exit Activity

The report found that nearly half of all women’s health exits occurred in the last five years, with total exit value reaching $48.2 billion between 2020 and 2024 – a nearly 70-fold increase from the $738 million recorded between 2000 and 2004. The year 2024 marked a record, with $21.4 billion in total exit value.

Diagnostics emerged as the strongest performing category, with median exit values 2.3 times the industry benchmark. The sector’s largest exits include Hologic’s $18.3 billion take-private in 2025, Cytyc’s $6.2 billion acquisition by Hologic in 2007, Alere’s $5.3 billion acquisition by Abbott in 2017, and BillionToOne’s $4.4 billion IPO in 2025.

“The exit opportunity in women’s health is real and predates the most recent wave of women’s health tech,” said Alice Zheng, MD, of Foreground Capital, who contributed data to the report. “We’re excited to see this comprehensive report, the first of its kind, highlighting historical traction and future opportunities.”

Why Exits Have Been Underreported

The report argues that traditional category frameworks have fragmented women’s health exit activity across broader verticals like diagnostics, medical devices, and oncology, obscuring the sector’s performance as a cohesive investment category.

“Platforms such as PitchBook have made important progress in introducing the ‘FemTech’ category, improving visibility into recent funding activity across the sector,” the report states. “However, like most databases, these platforms do not retroactively reclassify historical transactions.”

To address this, AOA Dx applied an expanded definition of women’s health that includes conditions unique to women (such as reproductive health and menopause), conditions that manifest differently due to sex-based biology (such as cardiovascular disease and Alzheimer’s), and conditions that disproportionately affect women (such as autoimmune disorders and osteoporosis).

According to McKinsey data cited in the report, just 5% of the overall disease burden affecting women is exclusive to female biology. The remaining 95% comes from conditions that affect women disproportionately or differently – yet these have historically received less attention from investors focused on women’s health.

Strategic Acquirers Driving Deals

Strategic buyers accounted for 91% of women’s health exits, with only 9% occurring through IPOs. Repeat acquirers demonstrated sustained commitment to the category: Hologic completed 22 acquisitions with $14.16 billion in total deal value, while CooperSurgical made 21 acquisitions totaling $4.5 billion.

“The presence of additional repeat acquirers – including Labcorp, Roche, Medtronic, and Allergan – reflects increasing strategic competition and reinforces women’s health as a priority growth area across diagnostics, devices, and services,” the report states.

“Women’s health is far more than reproductive care – it spans oncology, neurology, autoimmune, chronic disease and precision diagnostics that enable earlier detection and better outcomes,” said Megann Vaughn Watters, Head of Labcorp Venture Fund. “This report validates what Labcorp has long understood: women’s health platforms – especially diagnostics – are proven growth drivers, delivering strong returns.”

Capital Efficiency

Among 112 exits with disclosed funding and exit values, diagnostics and devices delivered the highest capital efficiency, with median outcomes exceeding 12 times capital raised and several exits above 50 times. The report defines capital efficiency as exit value divided by total capital raised.

“This pattern reinforces a critical investment insight: while women’s health has historically been undercapitalized, leading companies in the sector have demonstrated exceptional capital efficiency – a defining characteristic for both financial investors and strategic acquirers,” the report states.

Emerging Frontiers

The report identifies several areas poised for growth. Menopause and midlife health are described as “the next major frontier,” with growing focus on cardiometabolic risk, musculoskeletal decline, and hormonal aging positioning the segment to become a major pillar of deal activity.

The report also highlights conditions that sit outside traditional women’s health frameworks but disproportionately affect women: two-thirds of Alzheimer’s patients are women, over 80% of GLP-1 users are women, and women account for half of cardiac deaths while making up only 35% of clinical trial participants.

“Women’s health has become a scaled, diversified market, and the opportunity ahead is far larger than what is captured in today’s frameworks,” the report concludes. “As awareness, science, and data infrastructure improve, new areas of high unmet need are coming into focus.”

Katherine Anderson, Head of Life Science & Healthcare at HSBC Innovation Banking, said: “This analysis confirms that women’s health is a scaled, investable healthcare category with durable exit pathways. The range of outcomes across diagnostics, devices, and biopharma reflects both market maturity and sustained institutional demand.”